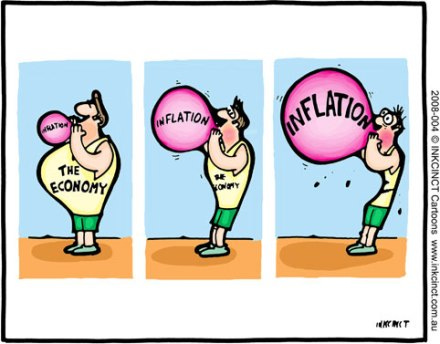

Central banking and inflation.

Quoted in WSJ:

From an interview with former Federal Reserve chairman Paul Volcker (Class of 1949) in the Daily Princetonian, May 30:

DP: [D]oes high inflation matter as long as it's expected?

PV: It sure does, if the market's stable. . . . The responsibility of the government is to have a stable currency. This kind of stuff that you're being taught at Princeton disturbs me. Your teachers must be telling you that if you've got expected inflation, then everybody adjusts and then it's OK. Is that what they're telling you? Where did the question come from?

DP: Okay. Could you talk a little bit about the justification behind the Volcker Rule and the effect you think it's had on the market?

PV: The rule is that institutions that are protected by the government, implicitly or explicitly, should not be engaged in speculative activities that bear no real relationship to the purposes for which banks are protected. Banks are protected to make loans, they're protected to keep the payments system stable. They're protected so you have a stable place to put your money. That's why banks are protected. They're not protected to engage in speculative activities which led to risk and jeopardized the banking system. That's the basic philosophy. I think it's pretty well-accepted. . . .

DP: Okay. And to get back to the central banking a little bit, given the trade-off between inflation and unemployment—

PV: I don't believe that. That's my answer to that question. That is a scenario and a delusion, which economists have gotten Nobel Prizes twenty years ago to disprove.