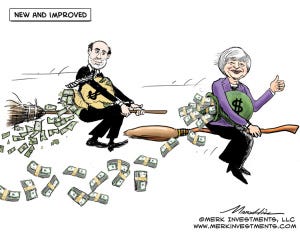

Did QE Work?

I repost this excerpt from About.com because it reveals an emerging consensus on our economic policies for the past 6 years, particularly monetary policy that has mostly stimulated asset speculation and accommodated negligent fiscal policy rather than stimulate the real economy.

QE achieved some of its goals, missed others completely, and may have created a bubble. First, QE did remove toxic subprime mortgages from banks' balance sheets, restoring trust and therefore banking operations. Second, it also helped to stabilize the U.S. economy, providing the funds and the confidence to pull out of the recession. Third, it kept interest rates low enough to revive the housing market. Fourth, it did stimulate economic growth, although probably not as much as the Fed would have liked.

However, it didn't achieve the Fed's goal of making more credit available. It gave the money to banks, which basically sat on the funds instead of lending it out. Banks used the funds to triple their stock prices through dividends and stock buy-backs. The large banks also consolidated their holdings, so that the largest .2% of banks control more than 70% of bank assets. Since banks didn't lend out the money, inflation wasn't created in consumer goods. As a result, the Fed's measurement of inflation, the CPI, stayed within the Fed's target. (Source: WSJ, Confessions of a Quantitative Easer, November 12, 2013)

However, QE did create asset inflation, first in gold and other commodities, and then in stocks, as investors were forced out of bonds. An ounce of gold more than doubled, rising from $869.75 to $1,895 between 2008 and 2011. After that, investors shifted to stocks. The Dow rose 24% in 2013 as corporations followed the banks' example and boosted stock prices with buybacks and dividends.