Economic Policy Report Card: C-

Today's headlines:

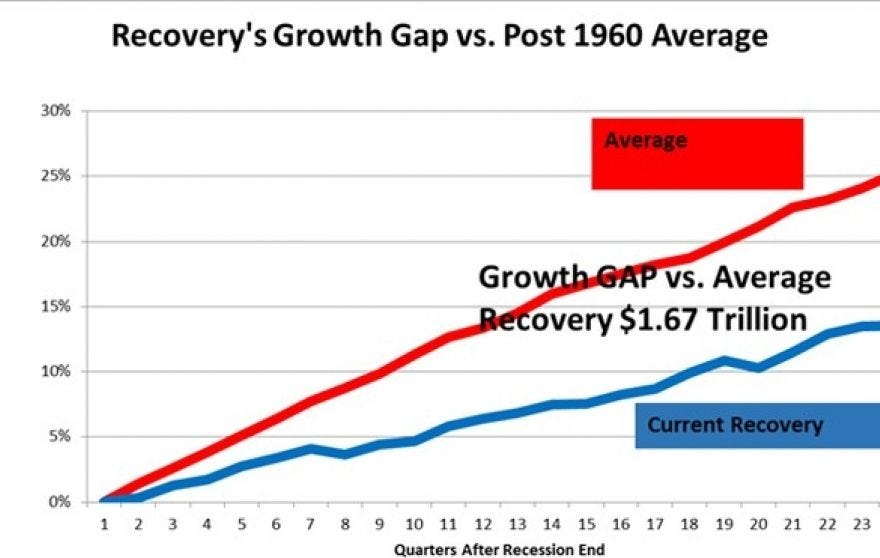

Still anemic: U.S. growth picks up to only 0.8%

U.S. economic growth between January and March was 0.8% compared to the same time frame a year ago. That's better than the initial estimate of 0.5%, which came in April, but still pretty sluggish.

US created 38,000 jobs in May vs. 162,000 expected

Job creation tumbled in May, with the economy adding just 38,000 positions, casting doubt on hopes for a stronger economic recovery as well as a Fed rate hike this summer.

The Labor Department also reported Friday that the headline unemployment fell to 4.7 percent. That rate does not include those who did not actively look for employment during the month or the underemployed who were working part time for economic reasons. A more encompassing rate that includes those groups held steady at 9.7 percent.

The drop in the unemployment rate was primarily due to a decline in the labor force participation rate, which fell to a 2016 low of 62.6 percent, a level near a four-decade low. The number of Americans not in the labor force surged to a record 94.7 million, an increase of 664,000.

We've been predicting such disappointing results of ineffectual monetary and fiscal policies since this blog began back in August of 2011. And providing corroborating evidence along the way. Yet our policy experts continue to double-down on failed policies.

The problem is that when a nation inflates asset bubbles like we did with commodities, houses, stocks, and bonds over the past 20 years, there is no silver-lining policy correction that does not involve some economic pain for the body politic. We had that awakening in 2008, but since then we have merely jumped on the same train by pumping out cheap credit for 8+ years.

Perhaps a medical metaphor works here. When prescribing antibiotics to combat an infection one can use small doses to avoid side-effects or one large overkill dose to knock-out the offending bacteria. The first treatment is the conservative, prudent approach that seeks a gradual recovery. The second risks a sudden shock to the system that kills off the infection so the patient can begin healing.

In medicine we've discovered that the gradual treatment can enable the bacteria to evolve and resist the antibiotics, making them ineffectual. In a nutshell, this is what we have done with economic policy, especially monetary policy that has distorted interest rates for more than 15 years.

The conservative approach marked by bailouts and government bail-ins has kept the patient flat on his back for 8 years. The more disciplined approach would have shocked the economy severely but gotten the patient out of the recovery room much quicker. We've seen that with other countries, like Iceland, that were forced to swallow their medicine in one quick dose.

But, of course, that would have meant a lot of politicians would have lost their cozy jobs. That may happen anyway after the next election.