Money For Nothing?

...there is now a nagging fear that credibility in central bankers is being lost. Investors, it seems, are losing confidence in the Fed.

You think? I believe the definition of insanity is to keep doing the same thing over and over and expecting a different result. It seems to me the Fed has sidelined itself and the future path of the economy will be determined by markets, and it won't all be good. As Stockman says (see second article below), the global economy in many respects is at peak debt, thus the global private and public sectors are both struggling to de-leverage. The only borrowers are national governments and those speculating in asset markets.

Thus, the Fed's efforts to boost inflation to 2% have been for naught and merely goosed asset markets and resource misallocation. For the global economy to re-balance from peak debt requires debts to be written down, something that occurs with bankruptcy accompanied by price deflation. Forestalling instead of managing these corrections only means a larger correction at some point in the future.

On another note, our experience is confirming the weakness of Friedman's monetarism. Inflation is not purely a monetary phenomenon - more important, it is a behavioral one based on demographics and the perceived level of uncertainty and risk regarding the future of the economy and policy distortions.

Markets reflect the collective intelligence of humans; they're not all stupid.

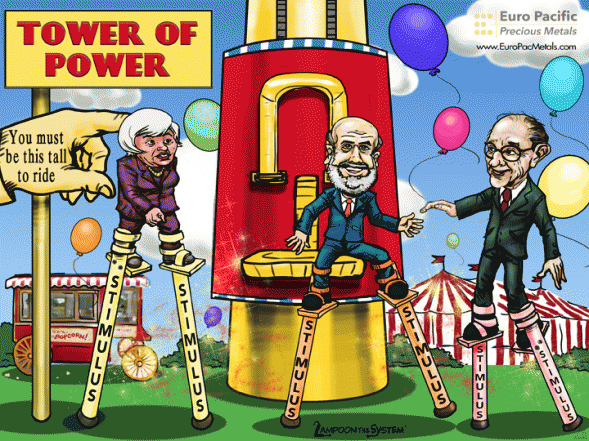

Why Wall Street’s Stimulus Junkies Weren’t Thrilled by the Fed’s Rate Decision

By Anthony Mirhaydari

September 18, 2015

It wasn't supposed to be like this.

In a massively hyped Federal Reserve policy announcement Thursday — one that threatened to end the nearly seven-year experiment with interest rates near 0 percent and usher in the first rate hike since 2006 — Chair Janet Yellen and her cohorts gave Wall Street exactly what they wanted: No change, in line with futures market odds.

And yet stocks drifted lower, even as the action in the currency and commodities market was as expected, with the dollar falling hard and gold up 0.8 percent. Why?

Cutting to the quick: Investors, it seems, are losing confidence in the Fed.

While the Wall Street stimulus junkies should've been happy with the continuation of the status quo, there is now a nagging fear that credibility in central bankers is being lost — something that RBS' Head of Macro Credit Research Alberto Gallo took to Twitter this afternoon to reiterate.

Moreover, the Summary of Economic Projections by Fed officials revealed that, at the median, policymakers now only expect a single rate hike by the end of 2015. The futures market is now pricing in a 49 percent chance of a hike at the December meeting (although Yellen noted that the October meeting was "live" and could result in a hike should markets and economic data improve).

But the kicker — the one that pushed large-cap stocks lower into the closing bell — was the appearance of a negative interest rate projection by a Fed policymaker on the newly released “dot plot.” Someone, it seems, expects federal funds policy rate to be in negative territory at the end of 2016. Four officials don't expect any hikes this year at all.

Not only does this undermine confidence in the state of the economy, but it calls into question the efficacy of the Fed's ultra-easy monetary policy stance that has been in place, to varying degrees, since 2008. Moving forward, it will be critical for the bulls to recover from Thursday's intra-day selloff. The day's action resulted in a very negative "shooting star" technical pattern that signals buying exhaustion and often precedes pullbacks.

In their statement, Federal Open Market Committee members fingered recent global economic weakness and financial market turbulence as giving reason to believe that inflation would take longer to return to their 2 percent target. So the new dot plot shows the median rate projection for the end of 2015 falling to 0.375 percent from 0.625 percent as of June; to 1.375 percent for 2016 vs. 1.625 percent before; and 2.625 percent for 2017 from 2.875 percent. The long-term neutral rate declined to 3.5 percent from 3.75 percent, signifying ongoing structural problems in the economy holding down its potential growth rate.

But a tree should be judged by the fruit it produces. In this case, median household incomes are stagnating despite all the Fed has already done, including three bond-buying programs and the "Operation Twist" maturity extension program. With corporate profits rolling over and global growth stagnating, people are wondering: Is this all the Fed and its central banking counterparts can do? Fresh threats, such as another possible debt ceiling showdown on Capitol Hill this autumn and an election in Greece, are approaching.

As for what comes next, Societe Generale Chief U.S. Economist Aneta Markowska suggests a replay of the late 2013 experience surrounding the beginning of the end of the QE3 bond-buying program: "Our scenario is reminiscent of 2013 when the 'taper tantrum' spooked the Fed in September, a government shutdown spooked the Committee in October, and the fog finally lifted by December when the taper was finally announced."

If the Fed left rates unchanged, there were some new wrinkles in its statement. In explaining their decision, Fed officials elevated issues like global economic growth and the dollar's valuation seemingly above its traditional mandate regarding labor market health. J.P. Morgan Chief U.S. Economist Michael Feroli believes investors shouldn’t read too much into the new factors being cited. In a paraphrase of the infamous rant by former Arizona Cardinals coach Dennis Green: Yellen is a dove. She is who we thought she was. And until higher inflation becomes a clear and present problem, this continual moving of the goalposts for Fed rate hikes — deferring until more data comes in — looks set to continue.

But that may no longer be enough to keep stocks happy.

-------------------

David Stockman is not a fan of the Fed. In fact he claims that the Fed is on a “jihad” against retirees and savers.

The former Reagan budget director and author of “The Great Deformation: The Corruption of Capitalism in America” visited Yahoo Finance ahead of the Fed announcement to discuss his predictions and the potential impact of today’s interest rate decision. “80 months of zero interest rates is downright crazy and it hasn’t helped the Main Street economy because we’re at peak debt,” he says.

Businesses in the U.S. are $12 trillion in debt. That’s $2 trillion more than before the crisis, but “all of it has gone into financial engineering—stock buybacks, mergers and acquisitions and so forth,” according to Stockman. “The jig is up; [the Fed] needs to get on with the business of allowing interest rates to find some normalized level.”

While Stockman believes that the Fed should absolutely raise rates today, he isn’t so sure that they will (Note: they did not). But even if they do, he says they’ll muddle the effect by saying “‘one and done’ or ‘we’re going to sit back and watch this thing unfold for the next two or three months.’”

This all fuels an inflationary bubble on Wall Street, according to Stockman. “This massive money printing we’ve had has never gotten out of the canyons of Wall Street. It’s sitting there as excess reserves.”

According to Stockman, the weakness of the U.S. economy has been due to a lack of investment over the past 15 years and inflated labor costs in America that can’t compete on a global scale. “Simply printing more money and keeping interest rates at zero do not help that problem.”

Zero interest policies, says Stockman, are leading to the global economic turmoil we are currently experiencing. “In the last 15 years China took its debt from $2 trillion to $28 trillion… it’s a house of cards with an enormous overcapacity and enormous speculation and gambling that is beginning to roll over,” he says. “It’s just the leading edge of a global deflation that I think is underway as a consequence of all this excess credit growth that we’ve had.”

If the Fed raises rates and doesn’t mince words there’s going to be a long-running market correction, says Stockman. If the Fed doesn’t raise rates there will be a short-term relief rally but eventually the markets will lose confidence in the central bank bubble and we’ll be in store for a “huge correction.”