Stop Us Before We Kill Again!

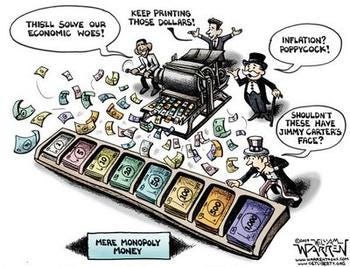

Central bankers warn the world about . . . central bankers.

From the WSJ:

The big financial news over the weekend, other than betting on the World Cup, is that the world's premier central bankers club is now warning the world about each other. The Bank for International Settlements issued a report warning that global monetary policies are reaching their useful limit and may be contributing to financial excesses that could turn out badly if central bankers aren't careful. [Really?]

"Financial markets are euphoric, in the grip of an aggressive search for yield," Claudio Borio, head of the monetary and economic department at the BIS in Basel, Switzerland, said as the club issued its annual report. "And yet investment in the real economy remains weak while the macroeconomic and geopolitical outlook is still highly uncertain."

That's not news for anyone paying attention to financial markets. Asset prices have been buoyant, and any given day brings reports of investors looking for bigger game. On Monday the Journal reported that the Blackstone Group, the private-equity shop, plans to start a hedge fund "to make big, bold bets" that it can pitch to wealthy clients. This will not mean investing in Treasury bills.

The BIS report cites several pungent facts, such as greater risk-taking in syndicated loans—"for instance, credit granted to lower-rated leveraged loans" exceeded 40% of new loans for much of 2013. "This share was higher than during the pre-crisis period from 2005 to mid-2007" and "fewer and fewer of the new loans featured creditor protection in the form of covenants."

All of this is especially notable because the BIS is warning about the policies its own fraternity brothers have been pursuing. Mr. Borio also has more credibility than most as a forecaster because he was one of those warning about the building financial excesses a decade ago. If Alan Greenspan and Ben Bernanke had listened to him as they were keeping the fed funds rate at 1% for a year amid economic growth of nearly 4%, we might have avoided much pain.

Most of Washington and Wall Street will not be any more receptive to this latest BIS message, but someone has to say it.