The Esoterica of Monetary Policy

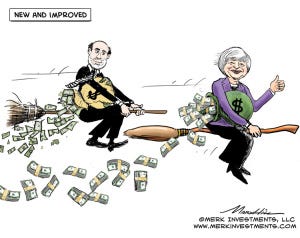

Okay, this discussion is guaranteed to put the average American to sleep. The notable signal is that the Fed has no plans to shrink its balance sheet and will remain a major holder of US housing mortgages into the indefinite future. Since when was the Fed appointed to actively manage the US real estate market?

The irony is that our lives are being run through this monetary policy mill. Most citizens will discover this long after the fact. From the WSJ:

Behind the Fed's Dovish Turn on Rates

After sending hawkish signals in July, the Federal Open Market Committee has softened its tone.

By Alan S. Blinder

The battle at the Federal Open Market Committee is now on. Score the previous meeting in late July for the inflation hawks, but last week's meeting went for the doves, who are more worried about jobs. I haven't discussed the meetings with any Fed officials, but here's my reading of what has been going on.

In the statement following July's FOMC meeting, Federal Reserve Chair Janet Yellen went to great lengths to placate the hawks with several language changes (but no policy changes). Instead of emphasizing that "inflation has been running below" the Fed's 2% target, as the committee had been saying, the statement observed that "inflation has moved somewhat closer" to 2%. And instead of calling the unemployment rate "elevated," it switched to the less ominous phrase "significant underutilization of labor." Such subtleties matter at the Fed, and markets took note of the more hawkish tilt.

The hawks were not placated. Because voting rights rotate among the reserve bank presidents, this year's voters include only two real hawks. One of the them— Charles Plosser of the Philadelphia Fed—dissented from the Fed's statement that low interest rates would be maintained "for a considerable time after the asset-purchase program ends," making the July vote 9-1. The other— Richard Fisher of the Dallas Fed—did not dissent formally, but had three days earlier made his disagreement known in these pages.

Last week Ms. Yellen gave no ground. The committee's hawks would like the phrase "significant underutilization of labor" removed from the statement. The Fed kept it. They want the FOMC to stop declaring that interest rates will remain at their current superlow levels "for a considerable time" after asset purchases end next month. The Yellen-led majority refused. The hawks want the Fed to stop saying that it expects to keep interest rates low "for some time" after the economy returns to normal. The Fed didn't. And there were a few more details, all pointing in the same dovish direction.

Mr. Plosser dissented again, and this time Mr. Fisher joined him, making the FOMC vote 8-2. There almost certainly would have been more dissents if other hawks could vote. At a consensus-based institution like the Fed, this constitutes deep division.

Yet another indicator of rampant disagreement appeared in the famous—to Fed watchers—"dots diagram," where each committee member is represented by a dot showing where he or she thinks the federal-funds rate should be in the future. Opinions on where the rate should be at the end of 2015 range from near zero all the way to 3%. The range is even wider for the end of 2016: from 0.25-0.50% to 4%. This is a remarkable degree of disagreement.

The Fed also released a new set of "principles and plans" for bringing monetary policy back to normal, finally replacing the principles it published in 2011, which said, among other things, that some balance-sheet shrinkage would come before interest-rate hikes. These new principles are rather vague, but Jeffrey Lacker of the Richmond Fed, another hawk, refused to sign on.

Fed watchers learned two main things from the new plans. First, that as the Fed "exits," it will not rely heavily on what are called "overnight reverse repurchase agreements"—in plain English, borrowing in the money markets. Rather, it will do such borrowing "only to the extent necessary and will phase it out when it is no longer needed." Market specialists had been all aflutter about this issue, some thinking it would become the Fed's primary instrument.

Second, while the FOMC still "intends" to exit without any outright asset sales from its huge portfolio, it hedged on that principle in several ways. For example, it said it "does not anticipate" selling any mortgage-backed securities, which prompted Mr. Lacker's dissent. Furthermore, the FOMC didn't mention selling Treasurys at all.

Regarding current monetary policy, the most notable and perhaps puzzling change in the Fed's official forecast was less optimism about real GDP growth in 2015. In its previous forecast, the "central tendency" among FOMC members was about 3.1%. Now the central tendency is about 2.8%. Not exactly an earth-shattering change. But as these things go, that's a pretty big revision in six weeks, and it isn't clear where the newfound pessimism came from. It does, however, suggest less urgency about raising rates.

The median FOMC member now thinks the federal-funds rate should be between 1.25% and 1.5% by the end of next year, and between 2.75% and 3% by the end of 2016. Both are higher than before, and a bit higher than traders expect.

One way to make sense of all this is to say, as some have, that the Fed may wait a little longer but then raise rates more rapidly once it starts. Perhaps. Another interpretation is that the Fed is projecting faster rate hikes because it is underestimating how strongly bond traders will push long-term interest rates up once Fed hikes begin. The central bank has underestimated market reactions before.