Time is Money?

Yes, but no. The actual truism should be stated as: "Money is Time." The difference, of course, is that time, not money, is the ultimate value. (The truism is probably most often stated in reverse because most people are confused as to the ultimate value of life, and thus respond better to the admonition that they are wasting money, not just time.)

Time is egalitarian. It is the great equalizer because in the course of a lifetime, an hour of time is equivalent to a rich or poor person alike, or a powerful or powerless person. Not equivalent as measured in terms of the currency of money, but equivalent as measured in time value.

"Money is Time" is also probably the most profound statement one can make in economics, because, in theory, economics uses money as the true measure of the value of time.

Think about this a little more deeply. What explains the differences in value between a horse, a car and an airplane? The difference in monetary value is explained by the efficiencies gained by a car over a horse, and an airplane over both. A horse can get one rider from Los Angeles to New York in probably about 2-3 months. A car can get maybe five or six people from LA to NY in about 3 days. An airplane can get 300+ people across the continent in about five and a half hours. If we compute and compare the three options in terms of man-hours expended, we can see why airplanes are valued that much more than a horse.

One could see this just as simply by comparing the productivity (in terms of time) of a tractor vs. a plow horse, or a computer vs. a typewriter, or a smart phone vs. a telegram. Technologies that allow us to make the most of our time are valued accordingly and displace less efficient technologies. And the time we gain is measured in monetary wealth.

This truism, that Money is Time, also has profound implications for how we control money as a measure of time. Money has been defined by its three functions: a unit of account, a store of value, and a medium of exchange. What money really does is tell us how much time value we have produced, saved, and stored up for future consumption. As such, money is merely an information signal that tells us if we are on the right track or not. If we are on the wrong track, being unproductive and wasteful, ultimately we have squandered time, not money.

I recently read a monograph by George Gilder, The New Information Theory of Money, that explores this relationship between time and money in depth. He observes that Neanderthal Man had the same natural resources that we have today, since all matter is conserved. Homo sapiens today is much wealthier because we live longer, we spend less time working for food and shelter, and have much more opportunity for leisure and cultural pursuits. Our wealth is really a measure of how productive we have become with our time.

Gilder's monograph analyzes what this means for our concepts of money. When we think of money as wealth, we come up with all sorts of schemes to increase the supply of money in order to increase wealth. When we consider the actions of the central banks for the past hundred years, we can see that this fallacy defines our misguided policies. This should be clear from the actions of the US Federal Reserve since the 2008 financial crisis, both leading up to that crisis and in reaction. Fed policy, referred to as Zero Interest Rate Policy and Quantitative Easing, has merely goosed the nominal prices of assets such as houses, collectibles, land, stocks, and bonds with the idea that more nominal wealth as measured in US$ will lead to greater productivity and real wealth as measured by the value of time.

It hasn't quite worked that way. Why? Because the Fed is focused on managing inaccurate statistical measures of real wealth as denoted by GDP, money incomes, CPI price changes, etc. Policymakers focus on the monetary economy rather than the real economy because that's what is measured by their statistical information. Perhaps it is the best proxy we have, but it is still a proxy.

You must ask yourself - are you richer in terms of time? More time for you and your family to spend as you see fit? Those few beneficiaries (the 1%) who have benefited directly from this misguided monetary policy can certainly answer yes, but for the aggregate body politic, the answer is no.

Money supply today is controlled by governments with their ability to expand and contract credit through the banking system. Thus, our monetary economies really operate according to the calculus of political power and influence. It is no accident that ZIRP taxes small savers in order to recapitalize large banks that made the bad loans that crashed the financial system. No wonder the majority of voters are disgruntled with the results.

Gilder explains the true value of money (as opposed to wealth), is as an information signal that helps us be efficient and productive with our time. When we distort this information source (which is exactly what the Federal Reserve does when it manipulates interest rates), we can only become less efficient and productive. He notes that gold was a more accurate basis for money information because its value was a direct function of the time and effort it took to get it out of the ground. Governments or private actors could not easily manipulate its value.

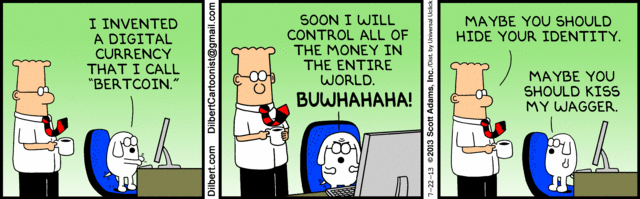

He applies this reasoning to an even better foundation for money, Bitcoin. Bitcoin is a digital currency that is "mined" by the application of mathematical algorithms that get more and more difficult to solve as time goes by. This means that in order for the supply of bitcoins to increase, we must become more and more efficient in terms of computing power. In other words, becoming more productive with time. You see, the more productive we are with time, the greater the wealth the monetary information signal should represent.

Currently, governments have little constraint over how much money they can create, meaning there is little hard discipline being imposed on political power. This can only be a dangerous state of affairs, as we know that power corrupts and absolute power corrupts absolutely. As I mentioned in a previous post, floating fiat currencies were intended (ala Milton Friedman's monetarism) to discipline politics, but have failed miserably to do so. In fact, they have achieved the opposite, creating more volatility and chaos in the global economy.

But, with digital currencies, power, influence, and wealth have little or no sway over the supply of money, which means they cannot manipulate the value to suit their narrow interests. Of course, those who hold political or economic power are loathe to surrender it, so we can expect powerful forces to be opposed to taking control over the money supply away from them. But a money that is directly connected to the value of time must be the most efficient and productive information signal that will increase the value of wealth measured in time, while insuring both liberty and justice for all. Remember, time is the great equalizer.

Digital currencies today are not yet developed to the point of replacing fiat currencies, but if this discussion captures your interest I would recommend reading up on technologies such as bitcoin. Much of the literature focuses on the efficiency of a digital payment system, but the real payoff in throwing off the yoke of fiat currencies will be in terms of liberty, justice, and true egalitarian democracy.