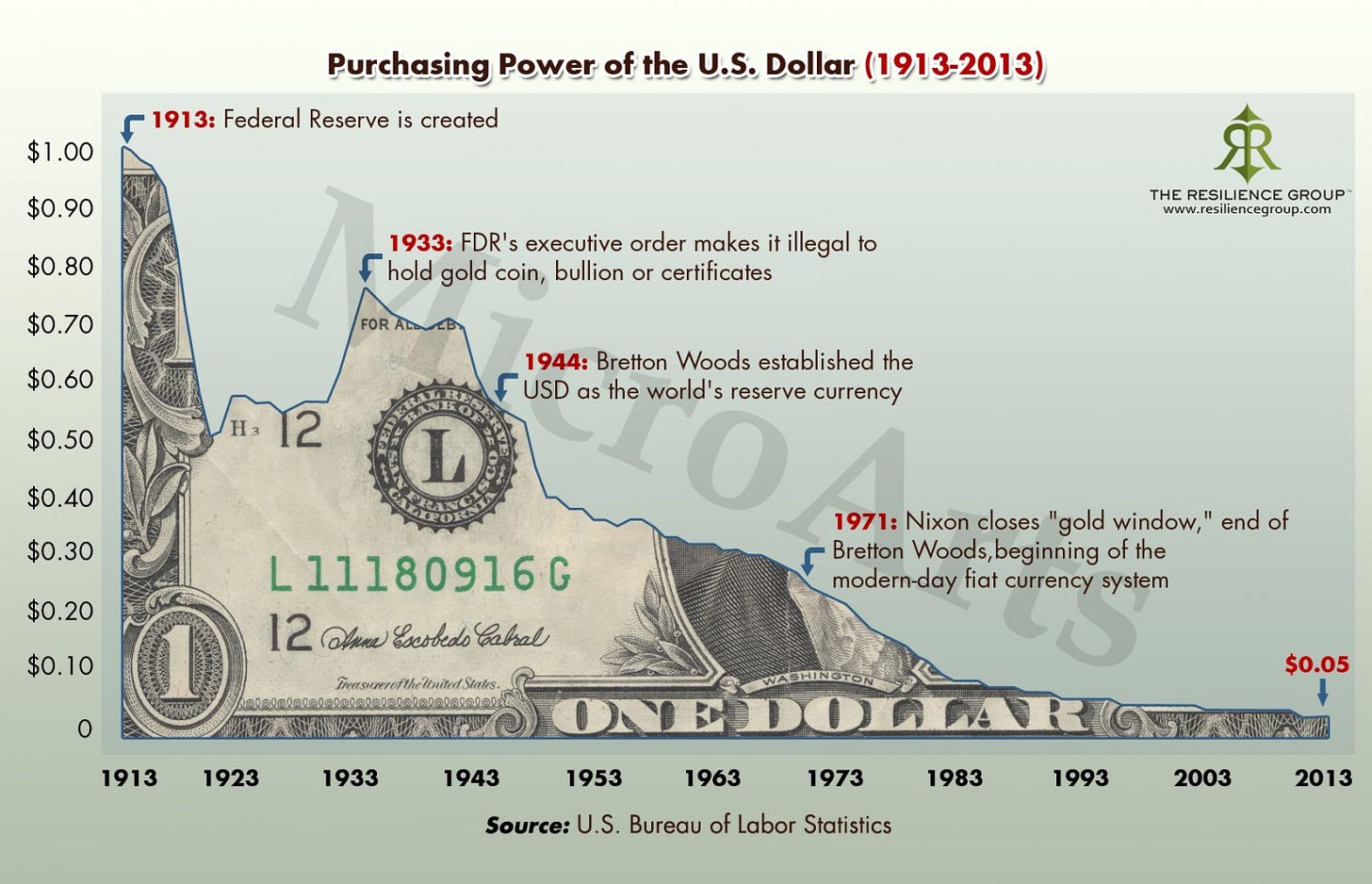

US Dollar Value under Management by the Federal Reserve

Eye-opening graph.

Fed advocates will argue that dollar depreciation over this period has also led to more than twenty times growth in wages and incomes. But the uncertainty of currency values does not affect all sectors uniformly and arbitrarily creates winners and losers. So, the growth in incomes has come at the expense of savers and older Americans living on fixed income pensions. It has greatly favored those who have done little except borrow to buy financial assets and real estate. So the question is: do we want an economy of 'four walls and a roof' or one of productive factories? The first is a depreciating asset, the second an appreciating asset.

As James Rickards puts it in his book, Currency Wars: "The effect of creating undeserving winners and losers is to distort investment decision making, cause misallocation of capital, create asset bubbles, and increase income inequality. Inefficiency and unfairness are the real costs of failing to maintain price stability."

More pointedly he writes:

The U.S. Federal Reserve System is the most powerful central bank in history and the dominant force in the U.S. economy today. The Fed is often described as possessing a dual mandate to provide price stability and to reduce unemployment. The Fed is also expected to act as a lender of last resort in a financial panic and is required to regulate banks, especially those deemed “too big to fail.” In addition, the Fed represents the United States at multilateral central-bank meeting venues such as the G20 and the Bank for International Settlements, and conducts transactions using the Treasury’s gold hoard. The Fed has been given new mandates under the Dodd-Frank reform legislation of 2010 as well. The “dual” mandate is more like a hydra-headed monster.

From its creation in 1913, the most important Fed mandate has been to maintain the purchasing power of the dollar; however, since 1913 the dollar has lost over 95 percent of its value. Put differently, it takes twenty dollars today to buy what one dollar would buy in 1913. Imagine an investment manager losing 95 percent of a client’s money to get a sense of how effectively the Fed has performed its primary task.

There is also an implication in the pro-Fed position that gradual inflation is necessary in order to grow the economy - an analogy to greasing the machine. But that is conjecture and disproven by robust growth during the latter half of the 19th century while we experienced mild deflation. As I have argued in Common Cent$, economic growth is a function of technology and population growth through increased labor productivity. Manipulating price values through monetary policy does little to promote long-term stable growth and only aggravates unfair economic inequality. It seems it takes a long time for each generation to discover this truth.