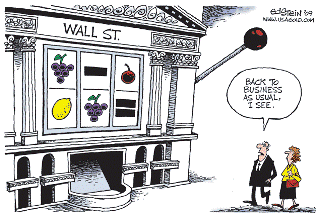

Welcome to the Fed's Casino

"What Happens in the Fed's Vegas ...Spreads Everywhere."

The article below focuses on the role of traders as the middle men between buyers and sellers of financial securities and the inefficiencies they generate from excessive churning. But trading volatility occurs in the context of a much larger issue of winners and losers in capital markets and society at large. Not only is trading excessive, but the swings in asset prices are creating massive winners and losers with arbitrary outcomes while enriching a winner-take-all circle of financial wealth that can buy up and shape our politics and regulatory policy.

These are the kinds of things that raise hackles among average Americans, but if we wish to fix the problem the more important question is how and why this has happened. It is a direct result of the Fed's monetary policy and our governments' fiscal policies in the face of a changing global economy. As I have explained in a previous post, Banking Vegas-Style, the focus of all macroeconomic policy on stabilizing headline statistics such as GDP growth, unemployment, and inflation has led to much greater price volatility in asset markets.

Economists refer to the past 35 years as The Great Moderation, denoting the reduction in the volatility of business cycle fluctuations starting in the mid-1980s. But to stabilize GDP growth with monetary liquidity means that excess liquidity must lead to productive investment. This is predominantly what happened with technology investment during the 1990s. But eventually excess credit leads to malinvestment and the misallocation of resources (Pets.com?). This is reflected in the volatility of asset prices, as we saw reflected in currency crises, the dotcom crash, commodity and housing bubbles during this same period we refer to as The Great Moderation. Others mark this time as the transition to the Bubble Economy.

The data that most reveals what has happened has been the explosion in trading and the transformation of capital markets into asset price casinos dominated by hedge funds, private equity, and big banking conglomerates. In other words, our policies created the hedge fund industry with currency volatility, credit bubbles and crunches, housing bubbles and crashes, commodity bubbles and crashes, and Too Big to Fail banks.

Think about it. If prices don't move in wild gyrations, there is almost no money to be made from constant trading. Instead we've turned such markets into casino gambling dens.

So, should this all be a surprise to our policymakers?

Legendary Fund Manager John Bogle Calls Wall Street’s Number—–99% Of Trading ($32 Trillion/Year) Is A Waste

by MITCH TUCHMAN @ Marketwatch • July 30, 2015

An astonishing $32 trillion in securities changes hands every year with no net positive impact for investors, charges Vanguard Group Founder John Bogle.

Meanwhile, corporate finance — the reason Wall Street exists — is just a tiny slice of the total business. The nation’s big investment banks probably could work for less than a week and take the rest of the year off with no real effect on the economy.

“The job of finance is to provide capital to companies. We do it to the tune of $250 billion a year in IPOs and secondary offerings,” Bogle told Time in an interview. “What else do we do? We encourage investors to trade about $32 trillion a year. So the way I calculate it, 99% of what we do in this industry is people trading with one another, with a gain only to the middleman. It’s a waste of resources.”

Rent seekers

It’s a lot of money, $32 trillion. Nearly double the entire U.S. economy moving from one pocket to another, with a toll-taker in the middle. Most people refer to them as “stock brokers,” but let’s call them what they are — toll-takers and rent-seekers.

Rent-seeking as an occupation is as old as the hills. In exchange for working to build up credentials and relative fluency in the arcane rules of an industry, one gets to stand back from actual work and just collect money.

Ostensibly, the job of a financial adviser is to provide advice. Do you actually get that from your broker? It is worth anything?

Research shows, over and over, that stock brokers can’t do much of anything demonstrably valuable. They don’t know which stocks will go up or down and when. They don’t know which asset classes will outperform this year or next.

Nobody knows. That’s the point. If you’re among that small cadre of extremely high-level traders who can throw loads of cash at a short-term fluke, fantastic. If you have a mind for numbers like Warren Buffett that allows you to buy companies on the cheap and hold them forever, excellent.

If you’re a normal retirement investor trying to get from A to B and retire on time, well, you have a really big problem to face: The toll-taker wants your money.

Dead weight

So he needs you to trade — a lot. Because that’s how stock brokers make money. Not by doling out retirement advice, but by ensuring that your account is active and churning commissions on behalf of them and their employers.

What’s a highway with no traffic on it? If you’re a toll-taker, it’s a money loser. So Wall Street’s rent-seekers need traffic in the form of regular trading. An account that sits invested for months at a time with no trades is dead weight to them.

Nevertheless, as Bogle maintains, doing nothing is the key. “Don’t do something, just stand there!” he has often said.

A portfolio indexing approach to investing codifies Bogle’s time-tested and effective way of investing for retirement — without lining the pockets of toll-taking stock brokers along the way.